About Us

Management of JTS Capital Group has an average tenure of 26 years experience of successfully investing in and managing assets in the financial services industry, inclusive of commercial banking, distressed asset investing and operating companies within the sector.

JTS was founded in 2013 by the former senior management of FirstCity Financial Corporation to invest in and service non-performing and stressed loans sourced from banks. Management has developed differentiated diligence, loan servicing, and collection capabilities that serve to mitigate risks and maximize returns for investors. JTS has a team of 12 professionals with specific expertise in commercial banking and distressed asset investing.

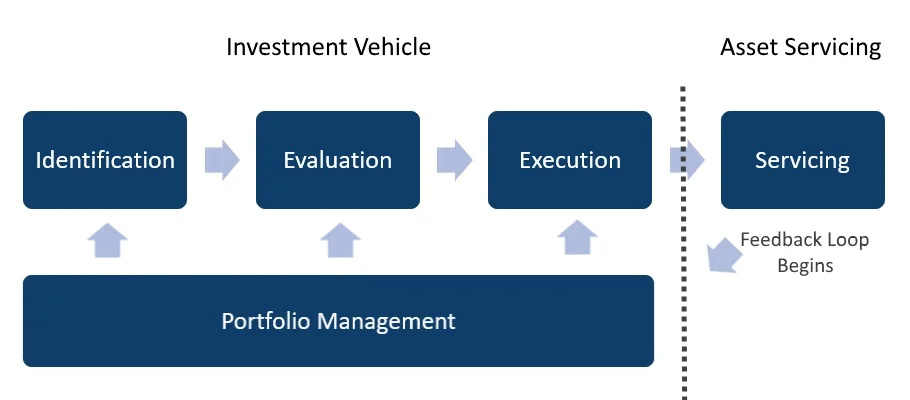

The JTS Investment and Servicing Process

Identification: The sourcing of Target Asset investment opportunities from financial institutions, government agencies and other sources, both for the Fund’s own account, and through investment entities that the Fund forms with one or more other co-investors, thereby capitalizing on the expertise of partners whose skills complement those of the Fund. Opportunities are identified by JTS’s Identification Team through traditional and non-traditional sources focused on motivated sellers and distressed and similar asset classes that meet the Fund’s investment criteria.

Evaluation: Extensive review of Target Assets is conducted by the JTS Evaluation Team, or its third-party designees, using proprietary underwriting processes and matrices that analyze and assess collection scenarios based on available data, including borrower status, collateral type, collateral value, market conditions, and litigation status. Individual cash flows are rolled up to the portfolio level with respect to pools of Target Assets and reviewed by JTS in order to determine final pricing and bid amounts.

Execution: Efficient and effective execution and closing of transactions using a process that ensures that the assets acquired by the Fund conform to applicable pricing expectations and pre-closing conditions. The Execution Team is also responsible for: sourcing and finalizing terms of financing arrangements; preparing a preliminary inventory of file documents; coordinating the legal transfer of ownership for the Target Assets, including notes and underlying collateral; and coordinating the transfer of information from the seller and the Execution Team to complete the transfer of servicing from the seller to the Servicer and/or any Designated Servicer.

Servicing: Immediate, focused attention of resolution specialists who negotiate individualized exit strategies and monitor all acquired Target Assets until resolution is complete.

Portfolio Management: JTS’s Portfolio Management Team collects and disseminates data gathered by the Acquisition Team, the Servicer and any Designated Servicer in connection with carrying out their functions within JTS’s model. They provide not only a resource for all Team members, but also a framework for a feedback loop that will allow JTS to continually and efficiently refine the “Identification,” “Evaluation,” and “Execution” stages of the investment process.